Welcome To Clear Business Finance

Your business finance experts

One point of contact with access to a wide range of financial solutions, securing you competitive terms every time.

We secure you preferential rates from over 60 handpicked partners.

We work with over 15,000 UK businesses and counting.

Why choose Clear Business Finance?

Over 90

Years’

Experience

UK wide coverage & support

Industry leading rates. No hidden fees.

Quotes in minutes, funding in days

95%

Approval

Rate

Dedicated Account Manager

Trusted by over 15,000 businesses across the UK and counting

We work tirelessly to ensure that your business gets the right funding at the right price, that is why a large percentage of applicants become regular Clear Business Finance customers.

Industry leading finance options

all in one place

- Equipment Finance

- Business Loans

- Vehicle Finance

- Invoice Finance

- Development Finance

- Green Energy Finance

- Merchant Cash Advance

Equipment Finance

How do you keep up with ever-evolving technology or acquire enough machinery to meet the requirements of a new contract? With equipment finance you have the comfort of knowing that technology related purchases can be upgraded at any point thus protecting you from ageing assets, while your budget will also stretch further allowing you to invest in more

machinery to see off the competition. Fixed monthly repayments allow

you to see a return on your investment from day one.

Business Loans

Business loans are generally seen as the most widely accessible form of funding but for this reason the options can seem overwhelming. We can make the choice Clear. Forget expensive credit cards and inflexible overdrafts, business loans are used to keep your cash flow healthy and provide greater peace of mind. Could your business benefit from a working capital injection

to help you realise your goals? Could breaking down an upcoming tax bill

into manageable instalments help to make your outgoings more manageable?

We are here to help.

Vehicle Finance

You pick the vehicle and we’ll organise the finance. Company directors, partners and sole traders can benefit from our highly competitive Leasing and Hire Purchase options. Fleet vehicles, company vehicles or luxury cars on flexible terms from 1 to 5 years, balloons up to 50% and no deposit required.

Discover Vehicle FinanceInvoice Finance

Do you often experience delays in getting paid for work you have done or goods you have sold? Your invoices can provide you with instant funding, no more waiting 30 – 120 days for payment, get your money upfront. Within 24 hours, up to 100% of your invoice can be available to you. Spot invoicing against individual invoices can also be arranged with no long-term financial commitment. Invoice Finance is not a loan; you’re not taking on any debt.

This helps to keep your cash flow healthy.

Development Finance

We can arrange up to 75% of gross development value or 80% of your

acquisition costs in as little as 24 hours. The funds can also be released in

stages as your development progresses, helping to keep your repayments

down. Alternatively, if you already own a property and are in need of

funding, we can now also arrange Commercial Equity Release.

Green Energy Finance

From Solar Panels, LED lighting and biomass boilers through to electric vehicles and charging points, there is an ever-increasing business case for companies to cut their energy bills and we are here to help you make the transition in a cash flow friendly manner! Your business could even be eligible for free solar panels to meet all your energy needs via a highly competitive power purchase agreement. How is your business performing? The ESG (Environmental, Social & Governance) standards are now a legal requirement for many.

Discover Green Energy FinanceMerchant Cash Advance

If you receive debt/credit card transactions via card terminal (PDQ) machines or an online payment system, you could be eligible for a sizable cash advance of between £25,000 & £1M. Unlike a traditional bank loan, with Merchant Cash Advance repayments will mirror the ups and downs of your business. Simply put - when you have a quiet period, you repay less. Funding that flexes with your cash flow!

Discover Merchant Cash AdvanceEquipment Finance

How do you keep up with ever-evolving technology or acquire enough machinery to meet the requirements of a new contract? With equipment finance you have the comfort of knowing that technology related purchases can be upgraded at any point thus protecting you from ageing assets, while your budget will also stretch further allowing you to invest in more

machinery to see off the competition. Fixed monthly repayments allow

you to see a return on your investment from day one.

Business Loans

Business loans are generally seen as the most widely accessible form of funding but for this reason the options can seem overwhelming. We can make the choice Clear. Forget expensive credit cards and inflexible overdrafts, business loans are used to keep your cash flow healthy and provide greater peace of mind. Could your business benefit from a working capital injection

to help you realise your goals? Could breaking down an upcoming tax bill

into manageable instalments help to make your outgoings more manageable?

We are here to help.

Vehicle Finance

You pick the vehicle and we’ll organise the finance. Company directors, partners and sole traders can benefit from our highly competitive Leasing and Hire Purchase options. Fleet vehicles, company vehicles or luxury cars on flexible terms from 1 to 5 years, balloons up to 50% and no deposit required.

Discover Vehicle FinanceInvoice Finance

Do you often experience delays in getting paid for work you have done or goods you have sold? Your invoices can provide you with instant funding, no more waiting 30 – 120 days for payment, get your money upfront. Within 24 hours, up to 100% of your invoice can be available to you. Spot invoicing against individual invoices can also be arranged with no long-term financial commitment. Invoice Finance is not a loan; you’re not taking on any debt.

This helps to keep your cash flow healthy.

Development Finance

We can arrange up to 75% of gross development value or 80% of your

acquisition costs in as little as 24 hours. The funds can also be released in

stages as your development progresses, helping to keep your repayments

down. Alternatively, if you already own a property and are in need of

funding, we can now also arrange Commercial Equity Release.

Green Energy Finance

From Solar Panels, LED lighting and biomass boilers through to electric vehicles and charging points, there is an ever-increasing business case for companies to cut their energy bills and we are here to help you make the transition in a cash flow friendly manner! Your business could even be eligible for free solar panels to meet all your energy needs via a highly competitive power purchase agreement. How is your business performing? The ESG (Environmental, Social & Governance) standards are now a legal requirement for many.

Discover Green Energy FinanceMerchant Cash Advance

If you receive debt/credit card transactions via card terminal (PDQ) machines or an online payment system, you could be eligible for a sizable cash advance of between £25,000 & £1M. Unlike a traditional bank loan, with Merchant Cash Advance repayments will mirror the ups and downs of your business. Simply put - when you have a quiet period, you repay less. Funding that flexes with your cash flow!

Discover Merchant Cash Advance

OFFER FINANCE TO YOUR CUSTOMERS

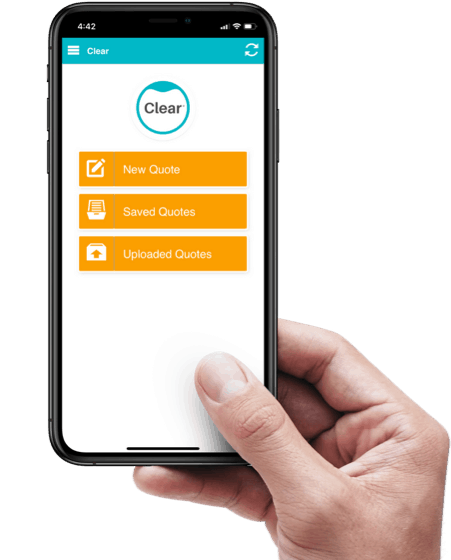

Business2business companies across the UK are now offering their client’s industry leading finance options via our newly upgraded app.

Breaking down the cost of any sale into manageable monthly instalments can allow you to secure more business, while you, the supplier, still crucially receives payment in full upon delivery of the equipment / solution.

Our app protects both yours and your customers cash flow, its win-win!

There are many sectors we’ve been active in

Learn more about how Clear Business Finance has helped other companies in your sector to realise their goals.

Success Stories

What are your ambitions and how can your business achieve them? Here are a few recent examples of how companies like yours are fuelling their growth plans with the right financial support.We all want the right tools for the job, so you will be pleased to hear we’ve made acquiring equipment a whole lot easier.

#DealOfTheWeek!

Winning a new contract is great but having the capital to meet the requirements, is just one example of how we help companies across the UK on a daily basis. #DealOfTheWeek!

The MD of a UK based property investment company asked us to organise the finance agreement for her new vehicle. It was a roaring success! #DealOfTheWeek

Breaking down the cost of your new plant machinery over a 1 to 5-year term, can allow you to limit your upfront outgoings & protect your cash flow. #DealOfTheWeek.

Get paid on time, every time. Your invoices can provide you with instant funding. No more waiting 30 - 120 days for payment, get your money upfront. #DealOfTheWeek!

80% of the sites value with no personal guarantees gave our client sufficient time to secure the site and gain planning permission.

#DealOfTheWeek

Protect yourself against asset depreciation & keep up with ever-evolving technology. Finance your tech related acquisitions & upgrade at any point. #DealOfTheWeek!

Our client was able to totally remove his business’s reliance on natural gasses and switch to green energy for a fraction of the cost.

#DealOfTheWeek

A financial solution where repayments flex in line with your future debit/credit card transactions, mirroring the ups & downs of your business. #DealOfTheWeek.

We are here to help

Still have questions?

Why not speak to a real person!

Expert help, whenever you need it.

Opening hours (Exc bank holidays)

8:30am - 5:30pm Mon to Thu

9am - 5pm Friday

We are here to discuss your options, assist with existing agreements and are more than happy to take applications over the phone.

Alternatively, here you will find the answers to some

frequently asked questions relating to our products and services.

"Good communication with a wealth of knowledge, should I have any future financial requirements then Clear are now my first point of call!"