Leasing

manage your cash flow with ease

Acquire the best equipment not just the cheapest, whilst minimising your outgoings.

We secure you preferential rates from over 60 handpicked partners.

We work with over 15,000 UK businesses and counting.

An introduction to leasing

set your business free

Businesses are having to evolve faster than ever before and this is largely because of innovation. Humanity has continued to push the boundaries of what is possible throughout the digital revolution, in a search for the next big thing. So ask yourself, how does your business plan to keep up with the continual evolution of equipment? Leasing could be the answer, we will let the key benefits listed below talk for themselves. Liberate your cash flow, protect yourself against asset depreciation, minimise or even remove your upfront outgoings and stay ahead of the competition.

Check your business’s eligibility - it's completely risk free!

Leasing key benefits

Get the equipment you need when you need it

As a business owner do you purchase the equipment you need or do you purchase the equipment you can afford or have a budget for? With leasing, your budget will go further. Think of what you could achieve with the right equipment.

Protection against ageing assets

So you’ve just invested heavily in new equipment and then something new comes out but your working capital has now gone. How do you continually evolve your business to ensure you are at the forefront of your sector? Leasing protects your cash flow and upgrade options prevent your equipment from becoming obsolete.

Improved return on investment

Pay only as you get the benefits. Paying over time and comparing the instalments against the immediately gained benefits, means it’s easier to cost justify any investment.

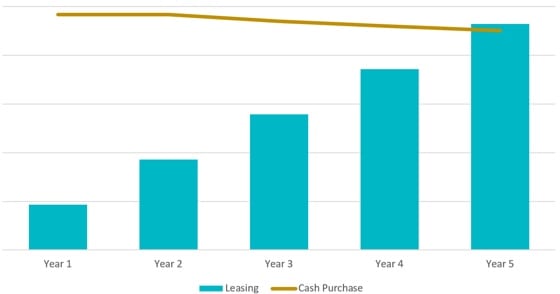

Cash flow comparison

Leasing allows you to drastically reduce your upfront outgoings, preserving your working capital for use on other projects. Also with leasing, 100% of the total rentals repayable are fully tax deductible against your current year profits.

Whereas cash purchases require a large upfront outlay and your tax deductions are based over the much longer period of the equipment’s writing down allowance.

What you will require

we like to keep it simple

What you will require

we like to keep it simple

-

The equipment’s full description, make, model & age.

-

The equipment suppliers’ invoice.

You can check your eligibility with the comfort of knowing this won’t affect your credit score. We are FCA regulated, so you know you’re in good hands.

Eligibility Checker

- UK-based business

- 3 years of trading history

- You must be an eligible signatory

What to expect

A dedicated account manager will be with you every step of the way.

Quotes are free and provided in minutes

you can expect to receive an email or SMS depending on your chosen method. Alternatively, a member of our knowledgeable team will be in touch if we need to ask a few more questions.

If you choose to proceed with your quote

your documentation can be issued digitally and processed via eSign in minutes. We do also offer traditional paper copies but we encourage you to think of the planet!

Funds can be released in as little as 24 hours

That’s it! Simple! We will pay your supplier directly once

you’ve received your equipment.

We are here to help

Still have questions?

Why not speak to a real person!

Expert help, whenever you need it.

Opening hours (Exc bank holidays)

8:30am - 5:30pm Mon to Thu

9am - 5pm Friday

We are here to discuss your options, assist with existing agreements and are more than happy to take applications over the phone.

Alternatively, here you will find the answers to some

frequently asked questions relating to our products and services.

"Clear are price competitive & provide a fast, efficient & friendly service"