Training on your terms

Office Based Training

For when nothing beats face-to-face learning. Our 1-day free training course is tailored to your requirements and can be carried out at your offices or ours. The choice is yours. We don’t limit the number of people that can attend and can deploy our app on the day.

Conference Call Training

It fits in with your busy schedule and allows us to skip the commute. Conference call training is now becoming the preference for many of the companies using our app. It's ideal for those looking for a short introductory to our offering or for those instances when time is a factor and you’re looking to get up and running quickly. (Conference call training still contains all the elements covered in our full day program, it's just a condensed version which we can conduct remotely.)

Online Resources

Learning at your leisure. We offer resources that you can refer to at a time that suits you. Whether for a recap after our course, or to help you outline the benefits to prospective clients. We’re always on hand to support your business every step of the way.

Office Based Training

For when nothing beats face-to-face learning. Our 1-day free training course is tailored to your requirements and can be carried out at your offices or ours. The choice is yours. We don’t limit the number of people that can attend and can deploy our app on the day.

Conference Call Training

It fits in with your busy schedule and allows us to skip the commute. Conference call training is now becoming the preference for many of the companies using our app. It's ideal for those looking for a short introductory to our offering or for those instances when time is a factor and you’re looking to get up and running quickly. (Conference call training still contains all the elements covered in our full day program, it's just a condensed version which we can conduct remotely.)

Online Resources

Learning at your leisure. We offer resources that you can refer to at a time that suits you. Whether for a recap after our course, or to help you outline the benefits to prospective clients. We’re always on hand to support your business every step of the way.

Trusted by over 15,000 businesses across the UK and counting

We work tirelessly to ensure that your business gets the right funding at the right price, that is why a large percentage of applicants become regular Clear Business Finance customers.

Who sells with Finance & Why?

Ask yourself, if all of these companies are offering their clients a finance option, is there something I'm missing out on...

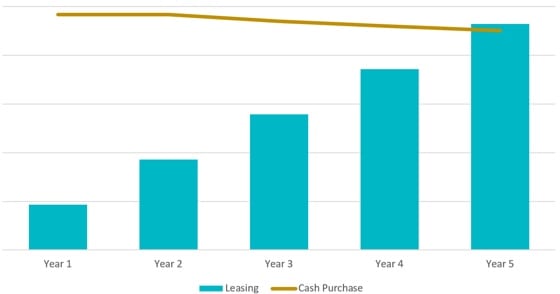

Cash flow comparison

Leasing allows your client to drastically reduce their upfront outgoings, preserving their working capital for use on other projects. Also with leasing, 100% of the total rentals repayable are fully tax deductible against your client’s current year profits.

Whereas cash purchases require a large upfront outlay and your client’s tax deductions are based over the much longer period of the equipment’s writing down allowance.

One document multiple options

Our easy to complete fully compliant finance agreements are accepted by a large variety of different funding providers. What this means is – only one set of documents are ever needed, fill in the details once and avoid unnecessary administration and re-signs.

Clear’s promise for our suppliers’ peace of mind is that, once your customer has signed on the dotted line, we will do everything possible to get the funds in place. Your clients will all vary in size & type, they will also likely range from sole traders through to limited enterprises, all with very different credit profiles. This is why we have partnered with over 60 of the UK’s leading finance providers to ensure we can cater for all.

- Limited companies

- PLCs

- Partnerships

- Sole Traders

- Local Authorities

- Charities & Churches

Pre-populated documents can be generated from within our app, issued digitally via eSign and processed within minutes. We do also offer traditional paper copies, but we encourage you to think of the planet.

OFFER FINANCE TO YOUR CUSTOMERS

Business2business companies around the UK are now offering their client’s industry leading finance options via our newly upgraded app

Breaking down the cost of any sale into manageable monthly instalments can allow you to secure more business, while you, the supplier, still crucially receives payment in full upon delivery of the equipment / solution.

Our app protects both yours and your customers cash flow, its win-win!

Here are some of the questions we commonly ask companies who are looking to offer a finance option to their customers.

We are here to help

Still have questions?

Why not speak to a real person!

Expert help, whenever you need it.

Opening hours (Exc bank holidays)

8:30am - 5:30pm Mon to Thu

9am - 5pm Friday

We are here to discuss your options, assist with existing agreements and are more than happy to take applications over the phone.

Alternatively, here you will find the answers to some

frequently asked questions relating to our products and services.

"By far the most helpful and effective Finance Company I have ever dealt with"